51+ can you deduct mortgage insurance premiums in 2021

The deduction for mortgage relief was introduced under the Tax Relief. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage.

Rental Housing November December 2021 Issue By Rental Housing Issuu

Mortgage around 200000 this means your PMI costs can range from 1000 to 4000 annually on top of your mortgage homeowners.

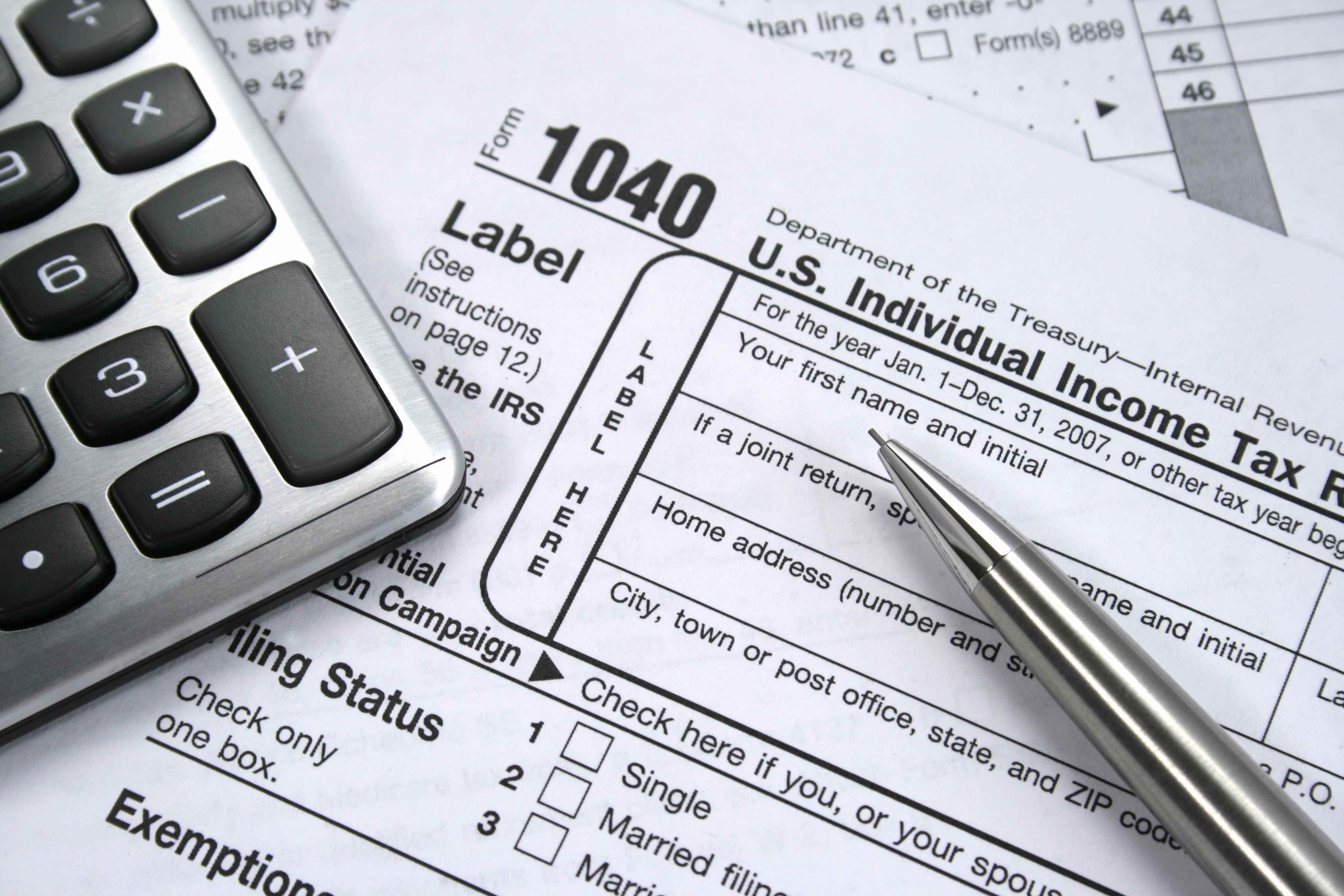

. Web No longer deductible in 2022. Per IRS Publication 936 Home Mortgage Interest Deduction. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

You can deduct mortgage insurance premiums mortgage interest and real estate taxes that you pay during the year for your. Web Mortgage Insurance Premiums. Premium paid by homeowners on mortgage insurance for FHA loans that can be deducted in the same manner as home.

Web To enter your qualifying mortgage insurance premiums as an Itemized Deduction. Web Qualified Mortgage Insurance Premium. Web Updated for filing 2021 tax returns Yes.

Web And with the average US. The most common type of deductible mortgage insurance premium is Private Mortgage Insurance PMI. Yes through tax year 2020 private mortgage insurance PMI premiums are deductible as part of the mortgage.

Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. According to the 2022 Schedule A Instructions The election to deduct qualified mortgage insurance premiums you paid under a mortgage insurance contract issued. Web Can you write off mortgage insurance premiums.

Web Mortgage Insurance Premiums you paid for a home where the loan was secured by your first or second home may qualify for the PMI deduction. Web Private mortgage insurance isnt necessary if you buy a house using a 20 or more downpayment. If you are claiming itemized.

Box 5 of Form 1098 shows the. From within your TaxAct return Online or Desktop click Federal on smaller devices click in. Web You can deduct amounts you paid for qualified mortgage insurance premiums on a reverse mortgage.

Web If your adjusted gross income AGI is below 100000 50000 if married and filing separately you can deduct your mortgage insurance premiums in full. However the insurance contract must have been. You can deduct home mortgage interest on the.

Health Slideshow Smc

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Can I Deduct Private Mortgage Insurance Premiums Tax Guide 1040 Com File Your Taxes Online

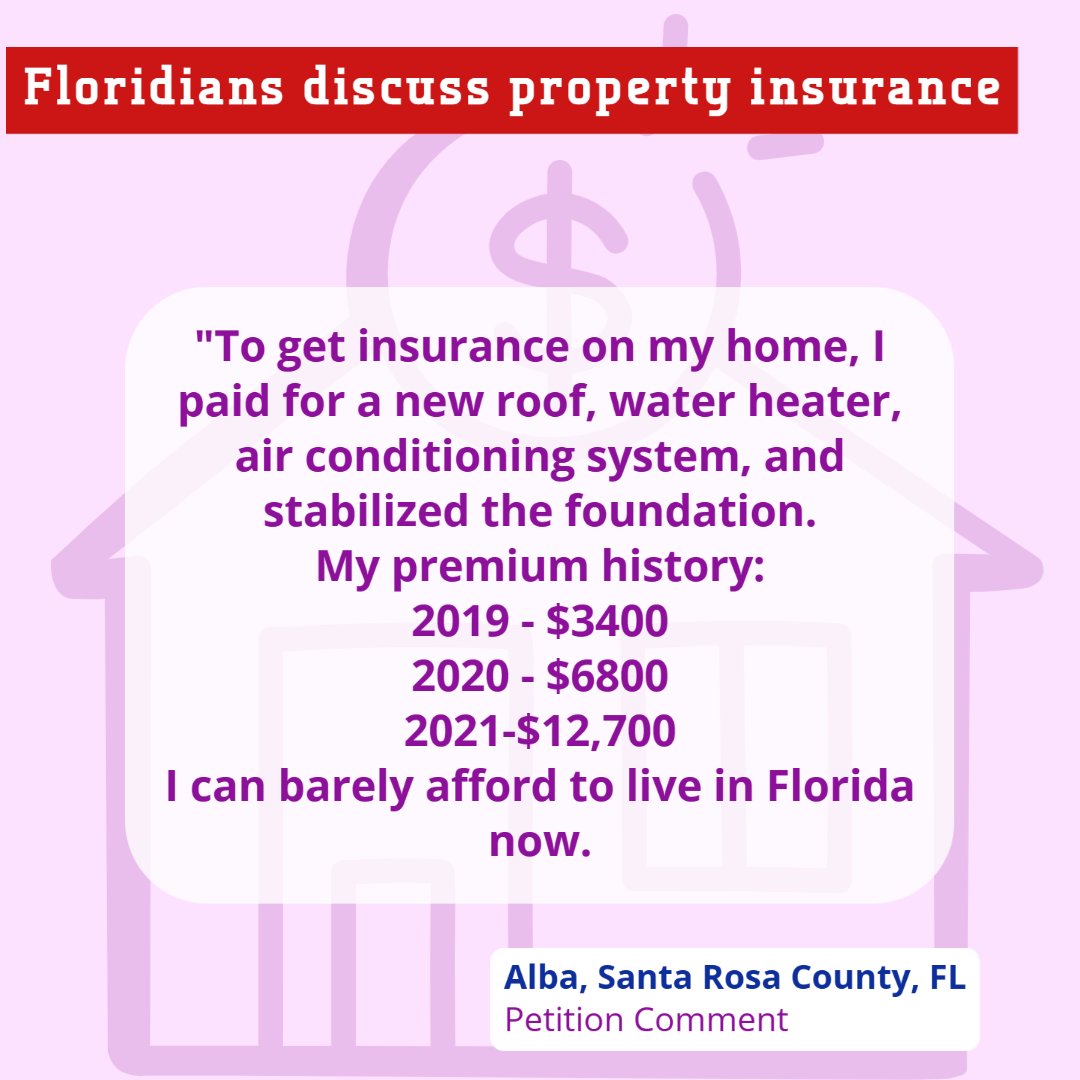

Floridians For Honest Lending Honestlendingfl Twitter

J K Lasser S 1001 Deductions And Tax Breaks 2022 2nd Edition Book

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Mortgage Insurance Deduction Legislation Introduced Themreport Com

Tweets With Replies By Floridians For Honest Lending Honestlendingfl Twitter

Is Mortgage Insurance Tax Deductible Bankrate

The Ultimate Guide To Financial Planning Myths Prosperity Thinkers

Is Private Mortgage Insurance Pmi Tax Deductible

Ev Energy Credits New Tax Deductions

Insurance Premium Calculation Download Table

Filing Taxes Mortgage Insurance Premium Tax Deduction Has Expired

5 Types Of Private Mortgage Insurance Pmi

Is Private Mortgage Insurance Pmi Tax Deductible

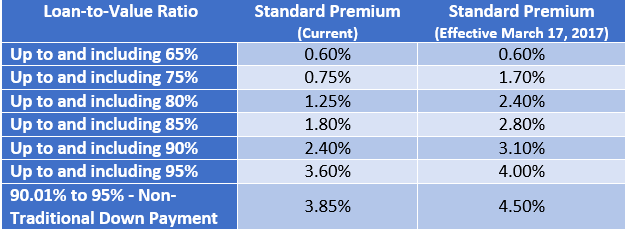

Mortgage Insurance Rates Are Going Up Here S What You Should Know Educators Financial Group